Leadership

Minimum Wage: Organised Labour Insists On Strike Despite Court Ruling

The Organised Labour has insisted on embarking on a nationwide strike over the non-implementation of N30, 000 as the new National Minimum Wage, in spite of the National Industrial Court ruling in Abuja.

Mr Ayuba Wabba, President, Nigeria Labour Congress (NLC) President, said this in an interview with the News Agency of Nigeria (NAN) on Friday in Abuja. The News Agency of Nigeria (NAN) reports that the National Industrial Court of Nigeria (NICN) in Abuja has restrained the organised labour from proceeding on a nationwide strike on Friday.

The nationwide strike by organised labour is scheduled to commence on Nov. 6 over the new National Minimum Wage for workers in the country. According to Wabba, we are not aware of any court ruling and we have not being served any notice.

“We have just concluded our joint organ meetings of the Central Working Committees of the Labour Centres of the NLC, Trade Union Congress (TUC) and the United Labour Congress (ULC) here in Lagos. “The meeting is the final preparation for a full engagement with the government on the new National Minimum Wage and we have taken our decision to go on the strike. “Our decision is to go ahead with the nationwide strike unless the government does the needful,” he said.

Also, Mr Musa Lawal, TUC General Secretary, also told NAN said the centre was not was aware of any court ruling concerning the planned strike by organised labour. “We are not aware because we have not been served any court order; we have taken our decision and we are going to stand by that,” he added. The News Agency of Nigeria (NAN) reports that the Nigerian Governors Forum (NGF) had issued a communique after its meeting claiming that state governors can only pay N22, 500, as the new national minimum wage.

The organised labour has reiterated its position that any figure below N30, 000 would not be acceptable to labour. Labour had earlier called on its members to mobilise in preparation for the commencement of an indefinite strike on Nov. 6, unless necessary steps are taken to adopt the recommendation of the Tripartite Committee.

Sourced From: Leadership Newspaper

Leadership

Suspend Nuclear Talks With Saudi Arabia, Senators Urge Trump

A group of Republican senators asked U.S. President Donald Trump on Wednesday to suspend civilian nuclear talks with Saudi Arabia after the murder of Saudi journalist Jamal Khashoggi and Saudi actions in Yemen and Lebanon.

The five U.S. lawmakers, led by Sen. Marco Rubio, said they would use the Atomic Energy Act to block any U.S.-Saudi nuclear agreements if Trump did not cut off talks. Others are senators Cory Gardner, Rand Paul, Dean Heller and Todd Young.

“The ongoing revelations about the murder of Saudi journalist Jamal Khashoggi, as well as certain Saudi actions related to Yemen and Lebanon, have raised further serious concerns about the transparency, accountability, and judgment of current decision-makers in Saudi Arabia,” the senators wrote. “We, therefore, request that you suspend any related negotiations for a U.S.-Saudi civil nuclear agreement for the foreseeable future,” said the lawmakers.

Representatives for the White House did not immediately respond to a request for comment on the letter, which was first reported by NBC News. Khashoggi, a leading critic of Saudi Arabia’s de facto ruler, Crown Prince Mohammed Salman, disappeared after visiting the Saudi consulate in Istanbul on Oct. 2.

The death of the Washington Post columnist, a U.S. resident who had American children, sparked global outrage and pitched the world’s top oil exporter into crisis.

The United States has called for transparency in the investigation of Khashoggi’s death and revoked the U.S. visas of some Saudis over the incident.

Trump has said Prince Mohammed bore ultimate responsibility for what happened to Khashoggi but has also cited Riyadh as a strong ally. U.S. Secretary of State Mike Pompeo and Defense Secretary James Mattis on Tuesday called for a cessation of hostilities in Yemen and urged the start of UN-led negotiations to end the civil war in November.

Saudi Arabia’s official comments on Khashoggi’s death have shifted from initially denying any involvement to saying the killing was premeditated. Both Saudi Arabia and Turkey are investigating Khashoggi’s death.

Sourced From: Leadership Newspaper

Leadership

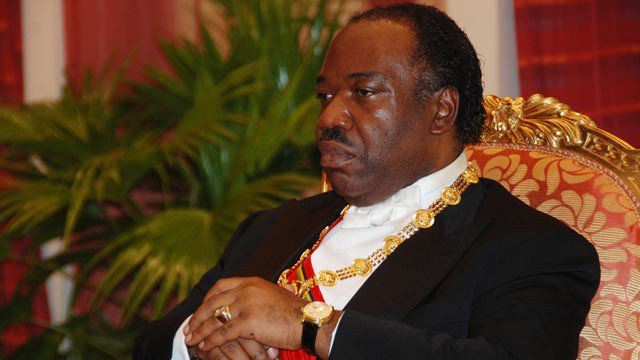

Gabon President, Ali Bongo Hospitalised

President Ali Bongo of Gabon has been taken into medical care after suffering a bout of exhaustion during a trip to Riyadh, Saudi Arabia, four days after he was hospitalised.

The President’s spokesman Ike Ngouoni said in a statement that the 59-year-old leader was in the Saudi capital for a flagship economic forum when he fell ill.

“The doctors who assessed him said he is suffering from severe fatigue due to extremely high levels of activity in recent months,” he said.

Bongo is feeling better and has been told to rest, Ngouoni added, while calling for “vigilance” against “fake news” following false reports of his death.

A Cameroon TV station had announced live on air on Saturday that the Gabon president had died, without providing any evidence, he said.

Bongo was scheduled to appear Wednesday on a panel at the Future Investment Initiative forum, but was not seen during the discussion.

Saudi Crown Prince Mohammed bin Salman visited him in Riyadh’s King Faisal hospital that evening, the official Saudi Press Agency (SPA) said on Thursday.

However, in a separate dispatch, SPA said Bongo attended a speech by Prince Mohammed at the conference later Wednesday.

Bongo took over as leader of the oil-rich equatorial African nation in 2009 on the death of his father Omar Bongo, who had ruled since 1967.

In 2016, Ali Bongo was re-elected by just a few thousand votes in a controversial presidential election.

The country went to the polls this month for the first time since that vote, with the second round of legislative elections Saturday seeing Bongo’s party coasting towards victory.

Sourced From: Leadership Newspaper

Leadership

Jamal Khashoggi Case; Foreigners Dump Saudi Stocks

Foreigners sold a net 4.01 billion riyals ($1.07 billion) in Saudi stocks in the week ending Oct. 18, exchange data showed on Sunday – one of the biggest selloffs since the market opened to direct foreign buying in mid-2015.

The selloff came during a week when investors were rattled by Saudi Arabia’s deteriorating relations with foreign governments following the disappearance of journalist Jamal Khashoggi.

Riyadh said on Saturday that Khashoggi died in a fight inside its Istanbul consulate, its first acknowledgement of his death after denying for two weeks that it was involved in his disappearance.

A breakdown of the exchange data showed foreigners sold 5 billion riyals worth of stocks and bought 991.3 million worth.

“The market started to price in a fundamentally different relationship between Saudi Arabia and the U.S.,” said Jaap Meijer, head of equity research, at Arqaam Capital.

“We believe the U.S. will keep Saudi Arabia as its close ally given (amongst other things) the importance of the kingdom in the Middle East region and being the producer of 10 percent of the world oil supply.”

U.S. Treasury Secretary Steven Mnuchin said on Sunday that Saudi Arabia’s explanation of the killing of journalist Jamal Khashoggi was a “good first step but not enough”, adding it was premature to discuss any sanctions against Riyadh over the incident.

The comments were the latest from the administration of U.S. President Donald Trump that appears aimed at censuring a killing that has sparked global outrage, while protecting relations with the world’s top oil exporter.

The stock exchange data also showed Saudi individual investors such as retail investors and high net worth individuals sold a net 3.4 billion riyals worth of stocks during the week, however, Saudi institutions bought a net 7.8 billion riyals worth of stocks. Investors from other Gulf countries were also net sellers.

Market analysts told Reuters last week that state-linked funds appeared to have mounted an operation to support the stock market after heavy foreign selling.

The Saudi stock market is down about 4 percent since Khashoggi disappeared on Oct 2. The market had already started to weaken before the incident as foreign funds slowed their buying after MSCI’s announcement in June that the kingdom will be included in its global emerging market benchmark next year.

The Saudi index closed up 0.2 percent on Sunday after falling as much as 3.5 percent earlier in the session.

Saudi Arabia’s foreign debt has also been pressured, with yields rising across the country’s dollar bond curve.

The yield on Saudi Arabia’s $5.5 billion bonds due in 2026 and $6.5 billion note due in 2046 rose to record highs last week, according to Refinitiv data.

Saudi credit default swaps, which investors buy as protection against default, rose to 100 basis points late last week for the first time since June, data from IHS Markit showed

Sourced From: Leadership Newspaper

Leadership

Oil Prices Climb Amid Saudi Tensions, But Demand Outlook Drags

Crude oil futures rose on Monday as geopolitical tensions over the disappearance of a prominent Saudi journalist stoked worries about supply, although concerns about the long-term outlook for demand dragged on prices.

Crude markets were also supported in the wake of data that showed South Korea did not import any oil from Iran in September for the first time in six years, before U.S. sanctions against the Middle Eastern country take effect in November.

Brent crude had risen $1.01, or 1.26 percent, to 81.44 a barrel by 0424 GMT, on track for its biggest daily gain since Oct. 9.

U.S. crude futures climbed 80 cents, or 1.12 percent, to $72.14 a barrel, extending gains they racked up on Friday after hefty losses on Wednesday and Thursday.

“The market has again expressed concerns over geopolitical tensions in the Middle East after U.S. and Saudi traded comments over the disappearance of the Saudi journalist, leading to a jump in prices,” Wang Xiao, head of crude research with Guotai Junan Futures, wrote in a research note.

Saudi Arabia has been under pressure since Jamal Khashoggi, a prominent critic of Riyadh and a U.S. resident, disappeared on Oct. 2 after visiting the Saudi consulate in Istanbul.

The kingdom would retaliate against possible economic sanctions taken by other states over the case, its state news agency SPA reported on Sunday quoting an official source.

Meanwhile, South Korea in September stopped importing Iranian oil for the first time in years.

“South Korea’s move to stop Iran oil imports is giving the market confidence on prices,” said Chen Kai, head of research at brokerage Shengda Futures.

Lingering geopolitical worries, trade concerns and a weaker economic outlook may pave the way for another week of volatile trading, Chen said, adding that Monday’s recovery in prices was “fragile”.

Putting downward pressure on oil prices, the International Energy Agency, the West’s energy watchdog, said in its monthly report that the market looked “adequately supplied for now” and trimmed its forecasts for world oil demand growth this year and next.

That comes after the secretary general of the Organization of the Petroleum Exporting Countries (OPEC) last week said the group sees the oil market as well supplied and that it was wary of creating a glut next year.

Sourced From: Leadership Newspaper