Nigerian Newspapers

Nigeria’s debt position

There has recently been a lot of misinformation and misconception in our public debate on debt. My goal in this article is to shed some light on the public debt, to clarify the real state of Nigeria’s debt position, and hopefully, provide a knowledge platform for constructive debate. Let me say at the outset that no one in government is supportive of a Nigeria that returns to a high state of indebtedness. On a personal note, having gone through tremendous stress during the quest for Paris Club debt relief, I am committed to a Nigerian economy that is fiscally prudent, balances its books and remains at a low state of indebtedness. To begin, Nigeria’s overall debt is comprised of external and domestic debts. The external debt is typically owed to foreign creditors such as multilateral agencies (for example, the Africa Development Bank, the World Bank, or the Islamic Development Bank), to bilateral sources (such as the China Exim Bank, the French Development Bank or the Japanese Aid Agency), or to private creditors such as investors in our Eurobonds. The domestic debt, however, is contracted within Nigerian borders, usually through bond issues which are then purchased by Nigerian banks, local pension funds, and other domestic and foreign investors. The resources raised typically go to help fund the budget or other domestic expenditures, such as infrastructure projects. We also have some contractor arrears, and other local liabilities which are normally handled through the budget. Both federal and state governments borrow domestically and externally. However, no state government can borrow externally unless guaranteed by the Federal Government. Similarly, state governments’ domestic borrowing is subject to federal government analysis and confirmation – based on clear criteria and guidelines that a state can repay based on their monthly FAAC allocations and internally generated revenues (IGR). As a nation, we have had a difficult history with debt. As such, no one can forget the challenging times we went through from 2003 to 2005 trying, in the end, successfully to get relief on our large external debt. Neither the government nor any Nigerian wants a repeat of the country’s past history of large debts. That is why the current President Goodluck Jonathan administration, the Legislature, the Ministry of Finance, and the Debt Management Office, are very focused on a conservative and prudent approach to managing the national debt. Our current approach balances Nigeria’s needs for investment in physical and human infrastructure with a strong policy to limit overall indebtedness in relation to our ability to pay. Above all, any debts incurred must go for directly productive purposes which yield results that Nigerians can see. *First the numbers:* a. In 2004, prior to the Paris Club debt relief, Nigeria’s overall debt stock was very high. External debt stood at US$ 35.9 billion while the stock of the domestic debt amounted to US$ 10.3 billion resulting in a total of about US$ 46.2 billion or 64.3% of GDP excluding contractor and pension arrears. b. After the successful debt relief initiative, Nigeria’s stock of foreign debt declined dramatically. Indeed, in August 2006, when I left office, Nigeria’s foreign and domestic debts amounted to US$ 3.5 billion and US$ 13.8 billion respectively – a total of US$ 17.3 billion or 11.8% of GDP. c. By August 2011, when I resumed for the second time as Finance Minister, the domestic debt stock had grown substantially to US$ 42.23 billion, while the external debt was still a modest US$ 5.67 billion. This implied a total debt stock of US$ 47.9 billion or 21% of GDP. Note that while the debt stock grew, our national income also grew so that debt to GDP ratio (the parameter used globally to measure a country’s debt sustainability) remains modest and manageable. d. Thus, the key noticeable change in Nigeria’s indebtedness in recent years has been the growth of domestic debt. There were two main reasons which resulted in this outcome. First, the initial growth of the domestic debt stock was because the federal government wanted to deepen the domestic debt markets and generate a yield curve for Nigeria which ultimately could help our corporate bodies to access the capital markets and borrow funds at more affordable rates. The DMO through its work has been successful in doing this. Nigerian corporates can now raise money at reasonable rates at home and abroad, helping them secure resources to invest in the economy. Secondly, however, domestic debt was also raised to finance increased budget expenditures including consumption. For example, in 2010, the 53% salary increase for civil servants was financed by raising domestic bonds. Borrowing for recurrent expenditure or consumption, as was the case here is a practice that is less than ideal and one that we should endeavour not to repeat. We must learn that domestic debt should be incurred sparingly at modest and manageable rates so that government is able to service it and pay back domestic creditors. Failure to do so would severely undermine the finances of our private and institutional creditors to the detriment of the economy. It is with this background in mind that we have put in place several measures to limit and manage the national debt. There are a number of specific policies we have introduced in the current administration to slow down the increase in our overall debt stock. a. First, we have brought expenditures and revenues much more in line, through a low fiscal deficit of 1.81% GDP, to reduce the need for domestic borrowing. For example, we reduced annual domestic borrowing from N852 billion in 2011, to N744 billion in 2012, and to N577 billion in 2013. Our objective is to reduce government’s domestic borrowing to below N500 billion in the 2014 budget. b. Second, for the first time, we have paid down part of our domestic debt rather than rolling all of it over. Beginning in February 2013, we successfully retired N75 billion worth of maturing domestic bonds. And we will continue with this practice in the coming years. c. Third, we have established a sinking fund with an initial capitalisation of N25 billion. This fund will enable the government to retire maturing bond obligations in the future. d. Fourth, we are working increasingly with states to get a clearer picture of domestic debts acquired by state governments, thanks to the comprehensive review recently completed by the DMO. Our particular concern is that state governments limit borrowings in line with their incomes and put any borrowings made to work on specific projects and programmes that bring direct beneficial results to their citizens. [Please find attached the Debt-to-GDP ratio of selected economies] e. Fifth, instead of the previous practice of contracting foreign loans in an ad hoc manner, we have streamlined the process for federal and state governments and made it transparent through the Medium Term Rolling External Borrowing Plan, which is reviewed and approved by the National Assembly. This plan presents the anticipated loans to be contracted by the government over a three-year time window, so that we can target funds to priority projects, and also make trade-offs where necessary. Notice that this covers planned foreign borrowing by both the federal and state governments for projects that will yield results in infrastructure, education, health, etc. Most loans contracted are on concessional or very favourable terms. For example, many of the multilateral loans are at zero interests, 40-year maturity, and 10 years grace. Others are at less than three per cent rate of interest. f. And finally, we have put forward a Medium-Term Debt Strategy with a mix of limited external and domestic borrowing that is appropriate for the economy. But let me repeat that we shall never be complacent about our national debt. We need to be constantly vigilant to limit the amount of debt and create room for the private sector instead to borrow. As such, we need to stay focused on three main priorities. First, we should continue to monitor our external borrowing and ensure that we do not slip back to our high indebtedness prior to the debt relief programme. As I mentioned earlier, the External Borrowing Plan, helps to address this concern by ensuring that we always have a comprehensive, transparent view of our foreign borrowing. As at now, our external indebtedness is low at $ 6.67 billion or about three per cent of GDP. Second, we should closely continue to monitor and limit our domestic debt, and ensure that it stays within a prudent and conservative range. We should pay off debt that is due to the extent of our ability. And third, we should also continue to closely monitor borrowing by states to ensure that the debt burdens of our state governments remain within manageable levels and that borrowings are applied to specific projects that yield results for citizens of the state. In that regard, we enjoin banks and other lenders to be careful and prudent when lending to ensure that this is done within the existing rules, regulations and guidelines. Former UN Secretary-General Kofi Annan once said: “Information and knowledge are central to democracy – and they are the conditions for development.” That is precisely why I have gone to some length to throw light on the real facts and the real issues regarding our debt situation and what the federal government is doing to address them. We need to create the basis to have a healthy and constructive public conversation on this issue, not a distorted and partisan battle. *• Dr. Okonjo-Iweala is Coordinating Minister for the Economy and Minister of Finance.*

————————————————————————————————————————-

Posted in Nigerian Newspapers. A DisNaija.Com network.

Source: The Nation Newspaper

DisNaija.Com publishes regular posts on Nigeria News, Nigerian Newspapers, Online Nigeria Gist.

Follow us on Twitter and Facebook.

Nigerian Newspapers

Follow @Dis_Naija

Your Opinion Counts. Be sure To Leave A Comment, If You Have Any.

Please Like, Share or Tweet. Your Support Is Appreciated.

This Day

Military, Police Ring Abuja to Forestall Boko Haram Attack

•Deploy more personnel as army chief vows to wipe out terror group

•Security beefed up at N’Assembly

Deji Elumoye and Kingsley Nwezeh in Abuja

Abuja, Nigeria’s seat of power, is under a massive security cordon following threats of attacks by insurgents and the increasing wave of banditry in the contiguous states of Kaduna, Kogi, Nasarawa and Niger States, THISDAY’s investigation has revealed.

There has been a wave of kidnappings in the outskirts of the federal capital, notably Pegi, Tuganmaje and Kuje among others, which the police have battled in recent times.

The security situation in and around the Federal Capital Territory (FCT) was heightened by the pronouncement of the Niger State Governor, Mr. Sani Bello, that Boko Haram fighters who he said sacked 50 villages in the state and hoisted the terror group’s flag, were about two hours drive away from the FCT.

Security has also been beefed up at the National Assembly as operatives, yesterday, thoroughly screened every vehicle approaching the National Assembly complex in Abuja.

The deteriorating security situation nationwide prompted the National Chairman of the Peoples Democratic Party (PDP), Prince Uche Secondus, to warn that the 2023 general election may not hold, demanding the declaration of a state of emergency as well as the convocation of a national conference.

However, the Chief of Army Staff, Lt. Gen. Ibrahim Attahiru, yesterday restated the Nigerian Army’s determination to annihilate Boko Haram.

But the Governor of Katsina State, Hon. Bello Masari, cautioned against declaring a state of emergency, saying doing so isn’t the solution to combat the security challenges facing the country.

The security of the nation’s airports was also in focus yesterday as the Office of the National Security Adviser (ONSA) said there was no threat to them.

THISDAY’s investigations showed increased presence of troops, police, Nigerian Security and Civil Defence Corps (NSCDC) personnel and intelligence operatives at the three strategic entrances to the city notably, Keffi, Zuba and Gwagwalada.

More checkpoints were also mounted around Gwagwalada and Keffi.

THISDAY also observed increased intelligence deployment at the entrance and the borders of FCT with contiguous states.

Beyond the borders, there were more deployments and police patrols inside the city and increased intelligence deployments as well.

Security sources told THISDAY: “There are deployments here and there but they are routine. Alertness is key to a secure environment.”

It was also learnt that security agencies were involved in frenzied meetings throughout yesterday.

The meetings, coordinated by the office of the Chief of Defence Staff under the new joint operational strategy of the armed forces, were aimed at coordinating a joint response to possible threats of attack to the FCT.

“I understand the security teams have been meeting for some days now and if you look around you, you will notice that there are increasing patrols and numbers of security personnel. The threats are not been taken lightly,” a source said.

National Assembly workers, lawmakers and visitors also had a harrowing experience accessing the legislative complex due to heightened security in the area.

Security operatives thoroughly screened every vehicle approaching the National Assembly complex in Abuja, impeding both human and vehicular traffic.

The Sergeant-at-arm of the National Assembly and other security agencies supervised the operations, leading to huge traffic build-up inside the complex.

Legislative staff, visitors and lawmakers were seen patiently waiting for their cars to be searched so that they could go ahead with the business of the day.

Some staff and visitors at some point got tired of waiting and were seen alighting from their cars to trek from the gate to the complex.

Meanwhile, the ONSA has said there is no threat to the nation’s airports.

A statement by the Head of Strategic Communication, Mr. Zachari Usman, said the reports of threats to the airports were an internal correspondence of security threat assessment misconstrued as security threat to the airports.

PDP Demands State of Emergency

In a related development, the PDP National Chairman, Prince Uche Secondus, yesterday demanded the declaration of a state of emergency, warning that the 2023 general election might not hold if the federal government failed to tackle insecurity.

He called on the federal government to summon a national conference to address the spike in insecurity.

Secondus added that the national caucus of the party will meet today to discuss the state of the nation.

Addressing members of the National Executive Committee (NEC) in Abuja, Secondus said: “We are worried Abuja is not even safe. It is no longer politics. We got alert of plots to bomb and burn down our airports.

“We urge the federal government to declare a national state of emergency in security. There is the need to call a national conference to discuss the insecurity in the country.

“There may not be any election in 2023 in Nigeria due to insecurity. This government must listen to the people. The Buhari government should call a national confab to discuss security and state of the nation. It is no longer politics. This time we are not playing politics. Let’s keep politics aside and move the nation forward.”

He said the country had been grounded, regretting that there had been no matching response from the federal government.

Secondus said in the past, terrorism in the North was confined to the North-east, but with the report of Boko Haram occupying villages in Niger State, terrorism had spread to the North-central

“Herdsmen are also menacing in the West; gunmen causing havoc in the East; and the militants in the South; all killing, looting, raping, maiming and burning down homes. The situation is bad; Nigerians all over are living in fear,” he said.

The Senate Minority Leader, Senator Enyinnaya Abaribe, said the problem of Nigeria was outside of the PDP headquarters, while pledging the support of the Senate to the declaration of state of emergency in security.

Abaribe said he deliberately decided not to speak on the floor of the Senate but to allow the APC senators to speak so as to avoid being accused of giving a partisan colouration to the issue of insecurity.

He stated that only electoral reforms would give victory to the opposition party in the 2023 general election and ensure a democratic defeat of the APC-led federal government.

Also, the Minority Leader of the House of Representatives, Hon. Ndudi Elumelu, commended the NEC and the PDP leadership for their collective efforts at resolving the House leadership crisis.

The NEC meeting adopted the position of Secondus, calling on the federal government to convoke a national conference to discuss the state of insecurity in the country, according to a communiqué read by the National Publicity Secretary, Mr. Kola Ologbondiyan.

Army Chief Vows to Wipe Out Boko Haram

The army yesterday reiterated its commitment to wipe out Boko Haram.

Chief of Army Staff (COAS), Lt. Gen. Ibrahim Attahiru, told reporters in Maiduguri, Borno State that Boko Haram had been defeated in many encounters and would continue to be defeated until it’s annihilated from Nigeria.

“We will take on Boko Haram decisively, and we are committed to the focus of the operations, which is the total annihilation of Boko Haram from Nigeria,” he said.

The COAS, who was visiting the headquarters of Operation Lafiya Dole in Maiduguri for the fifth time since his appointment four months ago, said the visit was to boost the morale of the troops, reassure them and listen to any issues affecting them.

Earlier, the Theatre Commander of Operation Lafiya Dole, Maj. Gen. Farouq Yahaya, lauded the visit, which he said had continued to boost the morale of the troops.

“We are honoured, we are grateful, we are encouraged by those visits. You provided us guidance, logistics and other things we required. We are most grateful for those visits,” Yahaya said.

State of Emergency Won’t Solve Security Challenges, Says Masari

Katsina State Governor, Hon. Aminu Masari, has, however, said declaration of a state of emergency won’t solve the security challenges facing the nation.

Masari, who spoke yesterday with journalists after meeting with the Chief of Staff to the President, Prof. Ibrahim Gambari at the State House, Abuja stated that he was against the recent call by the House of Representatives for the declaration of a state of emergency in the security sector as it would not solve the problem.

According to him, declaring a state of emergency will not achieve the desired effect as the security structure and personnel to be used to execute the emergency are already overstretched in a bid to safeguard lives and property.

Sourced From: THISDAYLIVE

Tribune

Nigeria records 55 new COVID-19 infections, total now 165,110

Tribune Online

Nigeria records 55 new COVID-19 infections, total now 165,110

The Nigeria Centre for Disease Control (NCDC) has recorded 62 new cases of COVID-19, bringing the total number of infections in the country to 165,110. The NCDC disclosed this on its official Twitter handle on Friday. “55 new cases of #COVID19Nigeria; Lagos-21, Yobe-19, Ogun-6, Akwa Ibom-3, Kaduna-2, Plateau-2, FCT-1, Rivers-1.” YOU SHOULD NOT MISS THESE HEADLINES FROM NIGERIAN TRIBUNE COVID-19: Nigeria Recorded […]

Nigeria records 55 new COVID-19 infections, total now 165,110

Tribune Online

Sourced From: Tribune Online

Vanguard

Attacks on S’East: We must explore all options of negotiation — Stakeholders urge Igbo

By Olasunkanmi Akoni

The people of the South East region have been urged to explore the power of negotiation and mutual settlement in the face of ongoing killings and security challenges in the zone because the east can not afford another war at present.

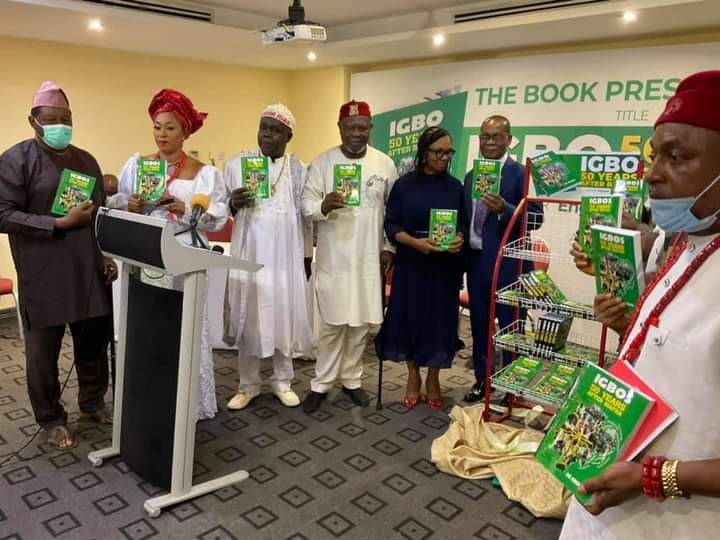

Stakeholders from the South-East geo-political zone made the remark on Thursday, at the unveiling of the book, “Igbo, 50 years after Biafra,” written by Special Adviser to Lagos State Governor Babajide Sanwo-Olu on Drainage Services, Joe Igbokwe, held at Ikeja G.R.A.

Speaking at the unveiling of the book, the chairman of the occasion, Mr. Cutis Adigba,

urged the people of the South-East to learn to build bridges across the country, so that they can realise their ambition of producing the next president of Nigeria.

Adigba urged leaders from the zone to discourage the move and agitation by some youths in the South East to go to war and secede out of Nigeria.

Also read: Banditry: Disregard viral video, Niger State gov’t urges residents

He said that Igbo have always found it difficult to rule Nigeria because they refused to build bridges across the six geo-political zones that made up Nigeria.

While describing the agitation as uncalled for, Adigba noted that after two decades that Nigeria returned to civil rule, the Igbo has predominantly identified with only one political party.

He maintained that remaining in one party can not advance the cause of the people of South East and cannot make them realise their objective of producing an Igbo man as president.

He maintained that the publisher of the book, Igbokwe played politics outside his state, so that the Igbo race can be integrated with one another race.

Adigba said the failure of the Igbo to reintegrate with other ethnic nationalities politically was responsible for the retrogression of the race in Nigerian politics.

Igbokwe, also addressing guests on the occasion, maintained that the Igbo are not advancing politically because they refused to be integrated into National politics, lamenting that, despite their success in business, they are not successful in playing politics at the national level.

Corroborating Dimgba, Igbokwe noted that there was the need for the Igbo people to stand up and build bridges so that their objective of producing the next president of Nigeria could be realised.

According to him: “I have decided to raise my voice, I hope my people will hear me while trying to quell the effect of the war, our people are spoiling for another war, mayhem is being unleashed in Igbo land, and there is palpable fear.

“Those who could speak have lost their voice, mindful of the consequences of their actions, I am calling on all Igbo leaders to speak up because all actions carry consequences, consequences of the silence will be too dastardly to sustain.

“Those silently supporting the wild wind should be careful or else they hand over to their children,” he said.

Igbokwe urged those spoiling for war to jettison their plan and embrace dialogue, urging them to learn from the South West region that despite the challenges faced after the annulment of the June 12, 1993, election, they did not go to war, and the region had the opportunity of producing two of her sons for presidential position in 1999.

“You have to build bridges to become president of Nigeria, but it is unfortunate the Igbo are burning bridges.”

Speaking at the event, Chief Uche Dimgba who is the coordinator of Igbo in All Progressives Congress, APC in Lagos, described Igbokwe as “a Frank, fearless and reliable leader, who based his views on issues and stand by his opinions, and we the Igbo have confidence in him and believe he can lead us aright.”

“He is a leader we Igbo believe in and we will follow him. If he can serve all the governors produced in Lagos State since 1999, he is a better man to follow because he possesses all the experience that can be of benefit to Igbo both at home and in the diaspora.”

The post Attacks on S’East: We must explore all options of negotiation — Stakeholders urge Igbo appeared first on Vanguard News.

Sourced From: Vanguard News

Premium Times

Insecurity: Lagos bans occupation of abandoned buildings

The government said that no worker should stay back beyond 6:00 p.m. within premises of buildings undergoing construction.

The post Insecurity: Lagos bans occupation of abandoned buildings appeared first on Premium Times Nigeria.

Sourced From: Premium Times Nigeria